Table of Contents Show

Quick take: Late-2024 data shows Leipzig’s population still rising and housing supply tight. For 2025, we project continued rental resilience for well-located, energy-efficient Condominiums in Leipzig, especially in A-/B+ micro-locations near transit.

Why Condominiums in Leipzig Have Long-Run Legs

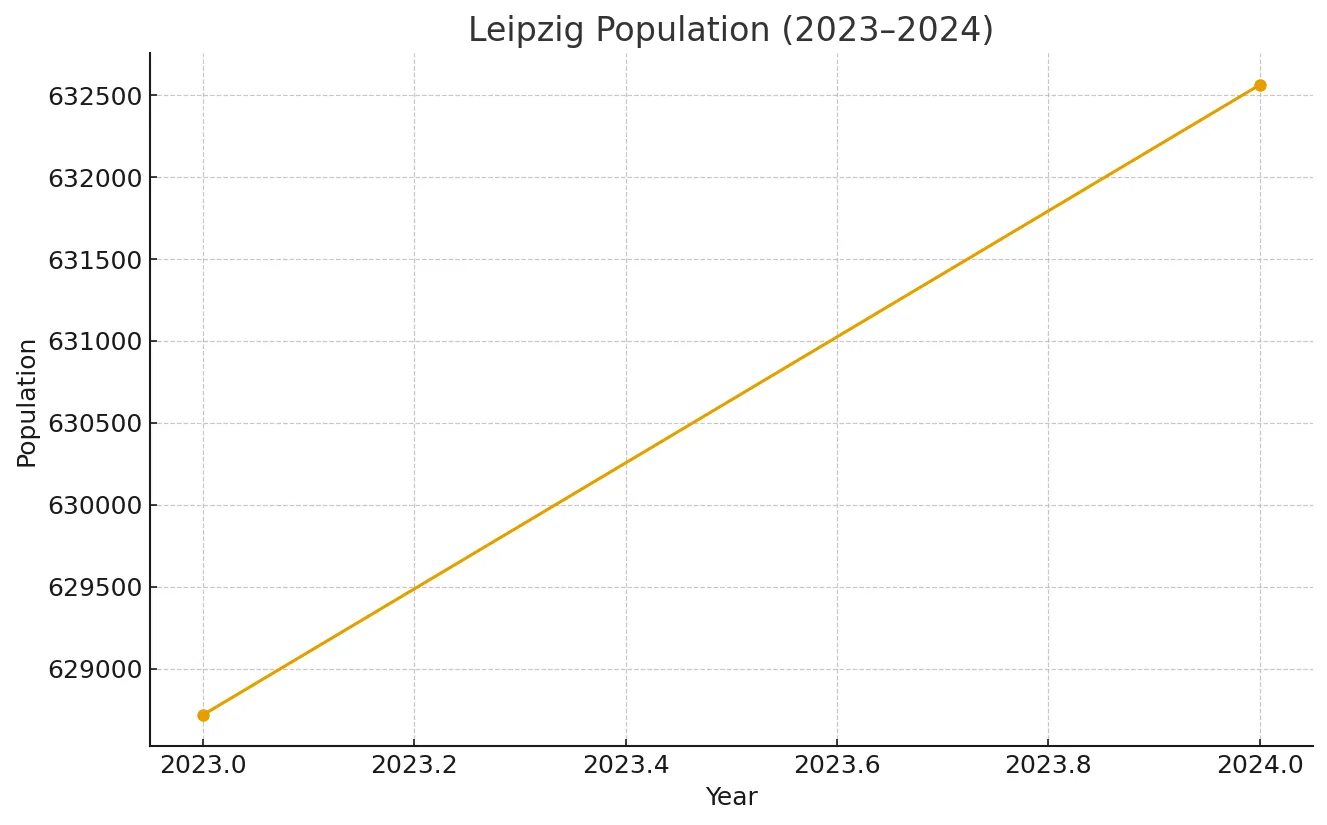

- Growing demand base: End-2024 headcount ~632,562 (+0.6% YoY). More households = deeper rental pool.

- Documented tightness: Late-2024 national reports flagged rent momentum consistent with a constrained pipeline.

- Real-economy anchors: DHL’s European express hub (LEJ) plus auto manufacturing (Porsche/BMW) support employment—and therefore occupancy.

- Underwritable rules: Leipzig applies the rent-brake (Mietpreisbremse) and publishes a qualified Mietspiegel 2025–2027; new-build first-lets and first-lets after substantial modernisation remain exempt—verify documentation during DD.

“Leipzig’s constrained housing pipeline and transit-rich micro-locations make energy-efficient condos a resilient, long-term hold.”

Marcus Umlauft, MRICS — Chartered Surveyor (Valuation)

Condominiums in Leipzig: 2025 Snapshot (What the Numbers Look Like)

Key points (TL;DR)

- 2025 figures are projections based on late-2024 trends and district medians; confirm with fresh comps.

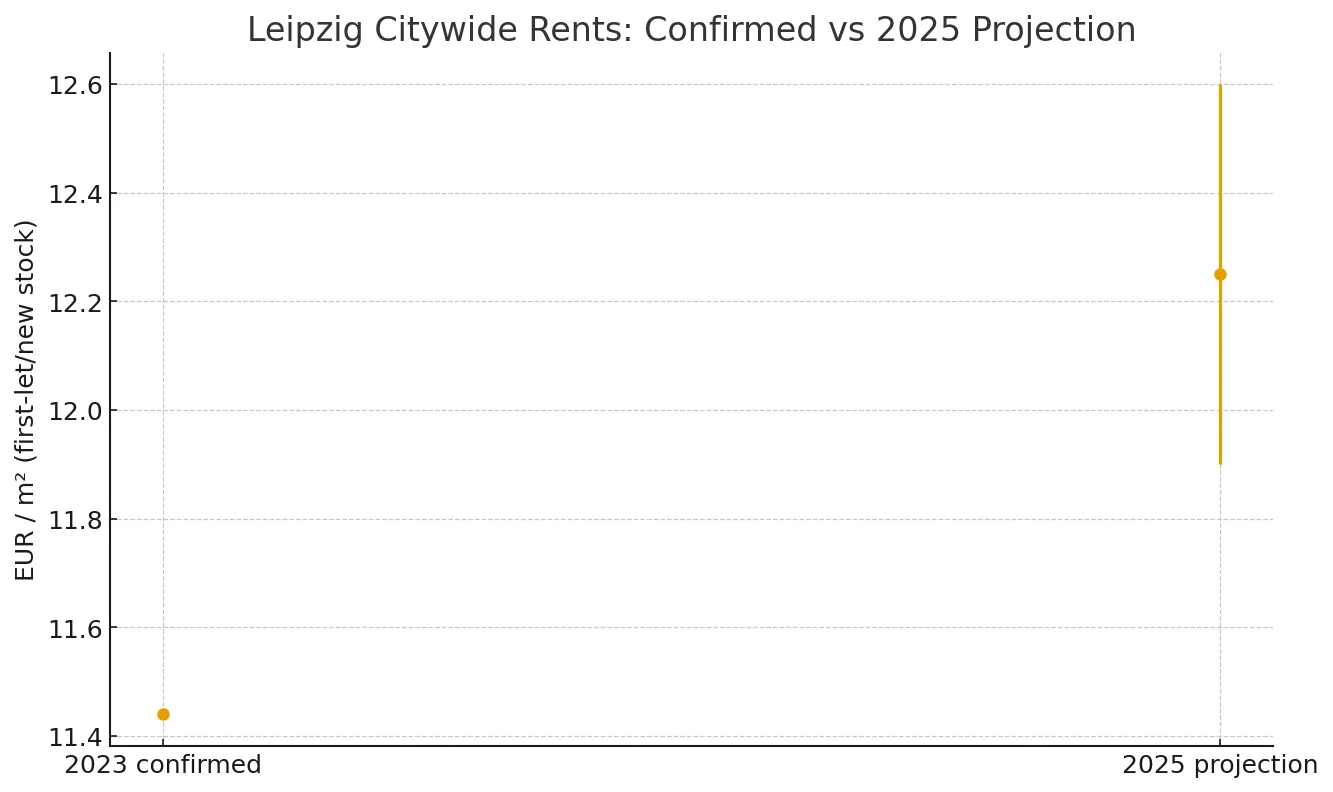

- Citywide first-let/new stock: prudent 2025 range €11.9–€12.6/m² (projection).

- Micro-location premiums: Mitte > Süd/Südost > rest; layout, EPC, balcony/lift materially affect rent.

- Illustrative gross yields: ~3.9–4.6% before Hausgeld/management/tax, depending on price and EPC.

- Always stress-test: run −5% rent and +€20/mo cost cases to check DSCR/returns.

Why it matters: Condominiums in Leipzig pair durable tenant demand with manageable operating costs when you buy for energy efficiency and transit access.

Methodology & primary sources

- Population baseline: End-2024 residents 632,562 (+0.6% YoY) from the City of Leipzig’s “Analysen zur Stadtgesellschaft” (official PDF & page). Trends from 2023→2024 inform demand assumptions.

- Rent structure (regulatory context): We reference the qualified Leipzig Mietspiegel 2025–2027, adopted by the City Council on 25 June 2025, which governs comparative rents and rent-brake calculations.

- District medians (micro-locations): First-let/new-build medians and the Mitte/Süd/Südost ranking use PISA Immobilien Leipzig Marktbericht 2024 (local primary dataset).

- Projection logic: 2025 bands are derived from late-2024 offered-rent momentum and district relationships observed in PISA, cross-checked against national context (BNP Paribas RE; DZ HYP). Projections are conservative ranges, not guarantees.

Methodology (summary): Figures combine the latest confirmed stats from 2024 with 2025 projections where stated. Projections are derived from late-2024 rent trends and recent district medians; they are not guarantees and should be stress-tested.

Citywide baseline: First-let/new-stock median (latest confirmed) ~€11.44/m² (2023 base). Late-2024 offered rents accelerated; if momentum normalises, a prudent 2025 range for first-let/new stock is €11.9–€12.6/m² (projection, not a promise).

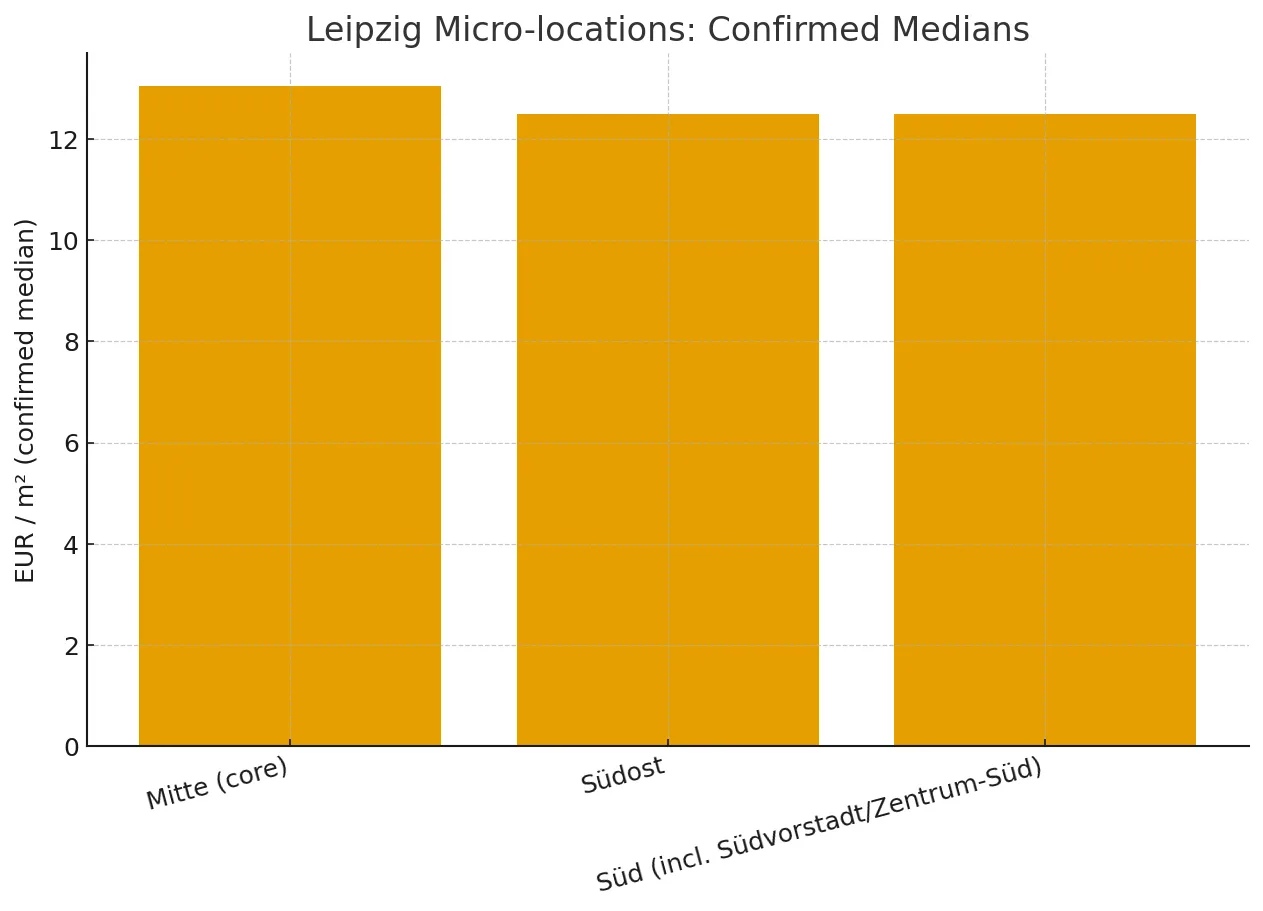

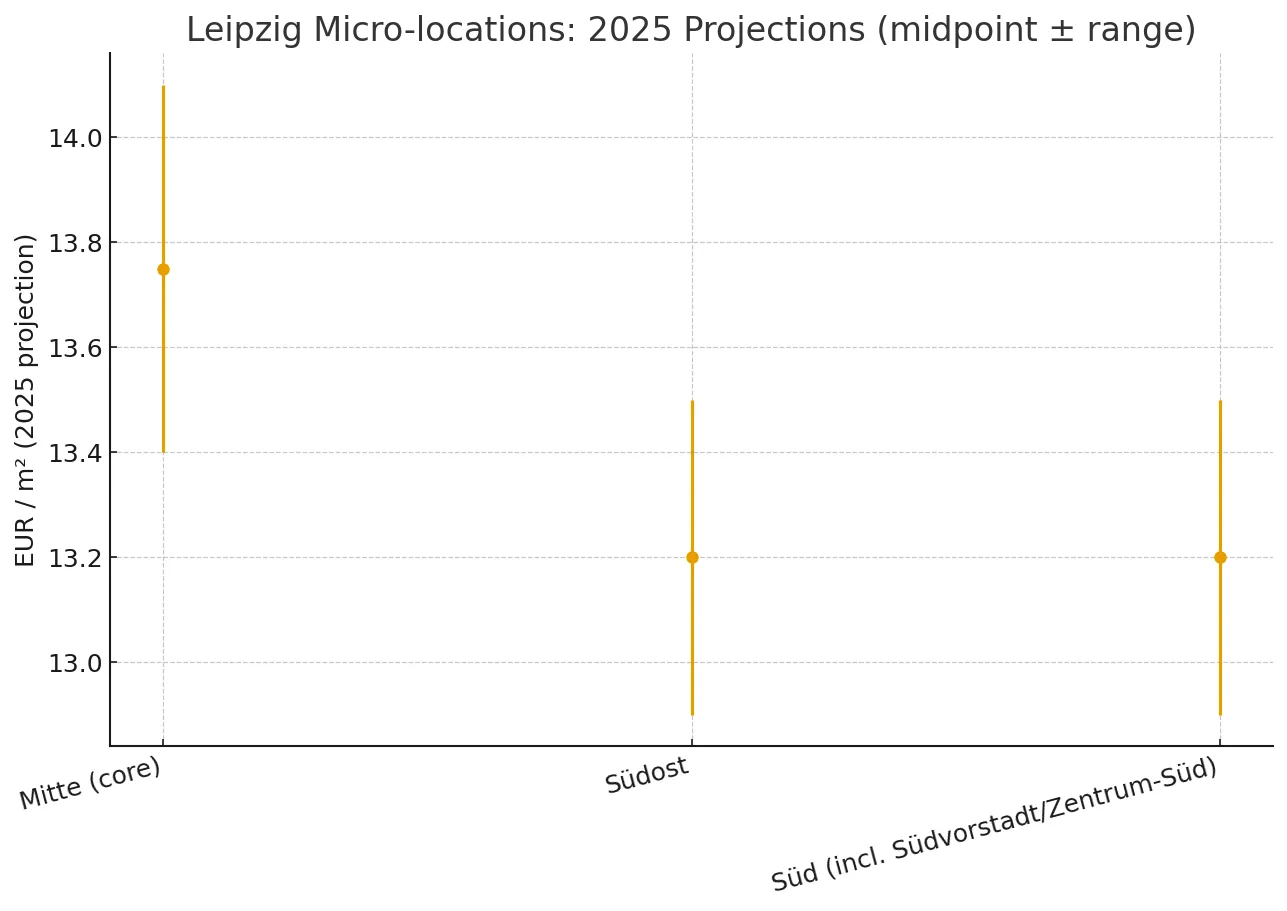

Condominiums in Leipzig: Micro-location Examples (confirmed medians; projections in italics)

- Mitte (core): First-let/new median €13.04/m² (confirmed). Projected 2025 band: €13.4–€14.1/m².

- Südost: First-let/new median €12.50/m² (confirmed). Projected 2025: €12.9–€13.5/m².

- Süd (incl. Südvorstadt/Zentrum-Süd): First-let/new median €12.49/m² (confirmed). Projected 2025: €12.9–€13.5/m².

| Metric | EUR / m² |

|---|---|

| Confirmed median (first-let/new stock, 2023) | €11.44 |

| 2025 projection – low | €11.90 |

| 2025 projection – high | €12.60 |

| 2025 projection – midpoint | €12.25 |

| Micro-location | Confirmed median (EUR/m²) | 2025 projection – low | 2025 projection – high |

|---|---|---|---|

| Mitte (core) | €13.04 | €13.40 | €14.10 |

| Südost | €12.50 | €12.90 | €13.50 |

| Süd (incl. Südvorstadt/Zentrum-Süd) | €12.49 | €12.90 | €13.50 |

Tip: District medians are a guide—street-level comps, EPC rating, balcony/lift, noise exposure, and WEG governance move achievable rents.

Deal example (fictional but realistic)

This example shows how Condominiums in Leipzig can underwrite with conservative rent bands and realistic operating assumptions.

Snapshot

- Asset: 60 m², 2-room, 2018 build, EPC C, balcony + lift (Südvorstadt).

- Purchase: €3,150/m² → €189,000; closing ≈ €14,355; all-in ≈ €203,355.

- Rent (projection): €12.9/m² → €774/mo → €9,288/yr gross.

- Ops (assumed): Hausgeld (non-reco.) €55/mo; mgmt 6%; vacancy 3%.

- Yield (est.): Gross ≈ 4.6%; Net (pre-tax) ≈ 3.6–3.8%.

Asset: 60 m², 2-room condo in Südvorstadt, 2018 build, EPC class C, balcony + lift.

Purchase: €3,150/m² → €189,000.

Closing costs (Leipzig/Saxony): transfer tax 5.5%, notary + registry ~2.0% ≈ €14,355.

All-in basis: ~€203,355.

Rent (projection): €12.9/m² → €774/mo → €9,288/yr gross.

Operating assumptions: Hausgeld (non-recoverable share) €55/mo; management 6% of gross; vacancy/turnover 3%.

Yields: Gross ≈ 4.6%; Net (after items above, pre-tax) ≈ 3.6–3.8%. Stress-test at −5% rent or +€20/mo costs to confirm DSCR comfort.

Risks for Condominiums in Leipzig—and How Smart Buyers Mitigate Them

Below are realistic “what-if” scenarios for Condominiums in Leipzig. Use them to pressure-test your model and documentation set (EPC, WEG minutes, reserve fund, planned works, tenancy paperwork).

What-if #1: Interest-rate shock at refinance

Scenario: Your 10-year fixed period ends into a higher-rate environment. Your payment rises +€120/mo, shaving 0.5–0.7 pp off your net yield.

- Mitigation: Choose longer initial fixes where sensible (10–15y). Target DSCR buffers ≥1.25× at underwriting. Maintain a 3–6 month expense reserve and pre-model a −5% rent / +€20–€40 cost case.

What-if #2: Energy upgrade requirement (EPC pressure)

Scenario: WEG votes façade/window upgrade and boiler modernisation. Your special assessment is €6,000; non-recoverable Hausgeld rises €15/mo, temporarily denting net yield by ~0.2–0.3 pp.

- Mitigation: Prefer EPC D/E (or better) assets and review WEG minutes + reserve balance before purchase. Get quotes for planned works. Model capex schedules and reserve contributions in your base case.

What-if #3: Rent-brake documentation challenge

Scenario: You assume first-let exemption (new-build/major modernisation), but the file lacks proof. A tenant dispute caps rent at the local reference +10% until proper documentation is supplied.

- Mitigation: Obtain the full exemption proof (first occupation date, modernisation scope/costs, prior rent evidence). Align your asking rent with current reference tables and keep written records.

What-if #4: Micro-location overpay

Scenario: A glossy finish tempts a bid above street-level comps; later you discover weak sound insulation and a nightlife hotspot nearby. Achievable rent is ~€0.5/m² lower than modelled.

- Mitigation: Use like-for-like comps (same street/amenities/EPC). Visit at night; check tram/bars/noise. Discount awkward layouts and low-reserve buildings; insist on recent sales evidence.

How to Buy Condominiums in Leipzig the Right Way

- Define the thesis: 45–70 m², 1–2BR, balcony, lift, <8-minute walk to tram.

- Finance & total cost: Model 5.5% transfer tax (Saxony) + ~2% notary/registry + WEG reserves.

- Due diligence: EPC, owners’ meeting minutes, reserve balance, planned works, house rules, rent comps.

- Offer with data: Anchor to district medians and recent sales, not headlines.

- Manage professionally: Local Hausverwaltung + annual rent benchmarking.

Further reading on DreamlandsDesign

- How to Buy Investment Property – 3 Top Tips

- Understanding the Role of a Mortgage Broker

- The True Cost of Home Ownership

FAQ: Investing in Condominiums in Leipzig

Is Leipzig still attractive for condo investors in late-2025?

Yes—end-2024 population growth, tight housing, and diversified employers support demand. Target efficient buildings and strong micro-locations.

Does the rent-brake (Mietpreisbremse) cap my rents?

Leipzig applies the rent-brake, but new-build first-lets and first-lets after substantial modernisation are exempt. Confirm current rules and keep documentation.

- City of Leipzig — Analysen zur Stadtgesellschaft (Population 2024 overview + PDF)

- City of Leipzig — Mietspiegel 2025–2027 (qualified; adopted 25 June 2025)

- City of Leipzig — Mietspiegel hub + calculator

- PISA Immobilien — Leipzig Marktbericht 2024 (first-let/new medians & district tables)

- BNP Paribas Real Estate — Residential Report Germany 2024 (national trends)

- DZ HYP — Wohnimmobilienmarkt Deutschland 2024/2025 (method & benchmarking)

- City of Leipzig — Grundstücksmarktbericht 2024 (Gutachterausschuss)

- Author: Perla Irish — Home & Real Estate Editor, DreamlandsDesign

- Reviewed by: Marcus Umlauft, MRICS — Chartered Surveyor (Valuation)