Table of Contents Show

In today’s world, the importance of buying or renting a house is widely understood. Both are equally tough.

For most people, a house is the largest investment they will ever make. It is also one of the most important financial decisions they will ever make. Because most people do not know the best way to buy a house, they choose to rent option.

The process of buying a house can be daunting, especially for first-time home buyers. There are many factors to consider when deciding whether or not to buy a house. Here are 5 things to keep in mind before buying a house:

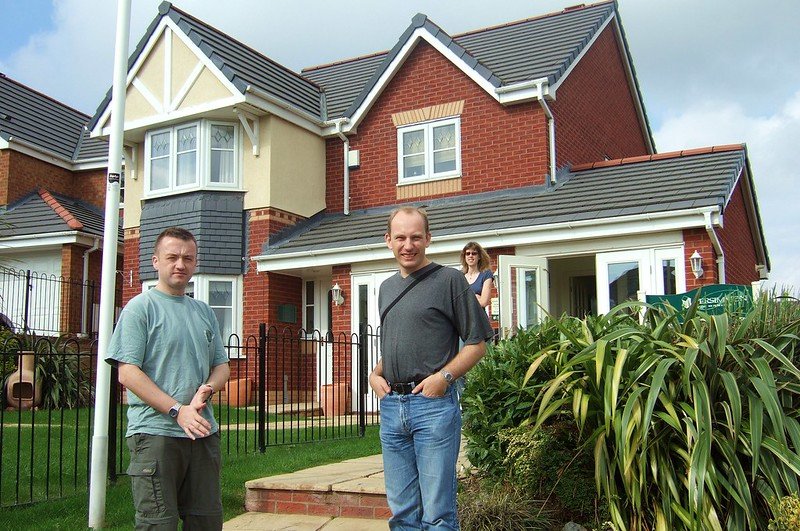

1. Location Is Key

When buying a house, one of the most important factors to consider is location. The location of a house can affect its value, desirability, and even its safety.

After all, you want to make sure you’re getting the most bang for your buck – and that means finding a neighborhood that you love. Consider the following when choosing a location for your new home:

Proximity To Amenities

How close is the house to grocery stores, schools, parks, and other conveniences? The closer the better!

Safety

Research the crime rates for the area before you buy. A safe neighborhood will be more desirable (and valuable) than an unsafe one.

Commute

If you have a long commute to work, you may start to resent your new home very quickly. Consider how far the house is from your workplace before making an offer.

Nearby School

Next, take a look at the schools in the area. If you have kids or plan on having them in the future, this is an important factor to consider.

Read Also:

2. Size and Layout

As you begin your house hunt, it’s important to keep in mind that size and layout are just as important as location. Not only do you need to find a home that’s the right size for your needs, but the layout must work for your lifestyle as well.

For example, if you entertain often, you’ll want a floor plan that flows well and has plenty of room for guests. On the other hand, if you have a large family, you’ll need a house with enough bedrooms and bathrooms to accommodate everyone.

It’s also important to consider how much outdoor space you need. If you enjoy spending time outdoors, you might want a home with a large backyard or patio. Or, if you prefer low-maintenance living, a smaller yard might be just right for you.

3. Check Hidden Costs of Homeownership

When you’re buying a home, it’s important to be aware of all the potential costs that come with homeownership. There are a lot of hidden costs that can add up, so it’s important to do your research and be prepared.

Some of the hidden costs of homeownership include things like maintenance and repairs, property taxes, and insurance. These are all things that can add up over time, so it’s important to be aware of them when you’re budgeting for your new home.

Another thing to keep in mind is that there may be some one-time costs associated with buying a home, such as closing costs or a down payment. Be sure to factor these into your budget as well so you don’t end up being surprised by any unexpected expenses.

4. Find A Good Real Estate Agent

When you are looking to buy a house, it is important that you find a good real estate agent. A good agent will be able to help you find the right house for your needs and budget.

They will also be able to negotiate on your behalf to get the best price possible. Here are a few tips on how to find a good real estate agent:

- Ask around for recommendations. Talk to your friends, family, and colleagues who have recently bought a house and see if they have any recommendations for agents in your area.

- Do some research online. Once you have a few names, check out their websites and read customer reviews.

- Meet with several agents before making your decision. It’s important that you feel comfortable with your agent and that they understand your needs. take the time to interview multiple candidates before selecting one.

5. Making an Offer

When you find the right home, you’ll need to make an offer. The seller may not accept your first offer, so be prepared to negotiate. Here are some tips for making an offer on a house:

- Start with your highest offer, but be willing to compromise.

- Get pre-approved for a loan before making an offer. This will show the seller that you’re serious about buying the house.

- Include a personal letter with your offer. This can help sway the seller in your favor.

- Be prepared to answer any questions the seller has about your offer. They may want to know why you’re offering a certain price or what contingencies you have in place.

- Be flexible on the closing date and other terms of the sale.

Conclusion

Buying a house is a big decision that should not be taken lightly. There are a lot of factors to consider, such as location, budget, and maintenance costs. It’s important to do your research and talk to experts before making a decision.